What is an Excel Insurance Rater Spreadsheet?

Excel Insurance Rater Definition

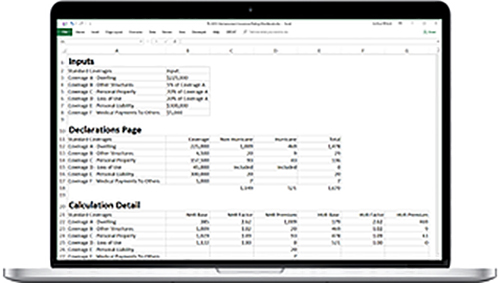

An Excel Rater, as it is called in the insurance industry, is a spreadsheet that calculates insurance premiums (“rates”). Premiums often have numerous components; each component must be meticulously calculated.

What Are Key Components of An Excel Rater?

Excel Rater Components

Excel raters typically contain many of these:

Rater Inputs collected from the insured (address, date of birth, value of insured items). Key rating inputs are typically drop down lists (multiple choice) or number ranges (fleet range of 1-10 vehicles).

Rating Algorithms are Excel formulas that contain the mathematical logic to calculate a rate component.

Rating Tables are lookup tables that contain rating factors. For instance, different earthquake territories will have different rating factors depending on the territory’s actuarial risk.

Rater Outputs are the components that make up the Premium. The Rater Outputs will often appear on the Dec Page.

Rater Quote Page is the professional format of your quote, displaying the applicant info, summary of cost, locations, standard coverages, optional coverages, additional coverages, premiums, forms, endorsements in the actual format the insured will receive. Save it as a PDF, and print it or email it to the insured.

Rater Binder Page is similar to your Rater Quote Page, with space for a signature, or whatever customization you desire.

Rate Change Analysis Pages use automation to run your entire book of business (or as many as you want) through new rate changes, then display summary results, and allow you to explore individual policies.

Takeout Pages uses automation to run your takeout policies through your rate algorithms, then summarize the results, and allow you to delve into individual policies. For example, Florida Homeowners Citizens Takeout.

What Are Other Terms For An Excel Rater?

Excel Rater Synonyms

Depending on the industry, line of business, and region, you might also see an Excel rater referred to as:

- Rater

- Rating Sheet

- Rating Workbook

- Excel Rating Sheet

- Excel Rating Workbook

- Automated Excel Insurance Workbook

What Insurance Industries Use Excel Raters?

Excel Rater Industries

Most insurance industries use raters. Those industries include:

- Commercial Auto

- Commercial Trucking

- Homeowners Insurance

- Auto Insurance

- Flood Insurance

- Medical Malpractice

Why Use An Excel Rater?

Common Scenarios Where An Excel Rater Can Help

An Excel rater may help in these situations.

- Developing new insurance products

- Rating prototype for rating software

- Transitioning to new rating software

- Test effects of possible rating change effects on an existing book of business

- Create an accessible insurance rating audit trail

- Rater serves as the actual rating calculation engine inside larger software

How Is An Excel Rater Developed?

Excel Rater Development Process

The successful rater development project has meticulous specifications, often including:

- Underwriting Manual

- Rating Worksheet (the “map” that serves as a guide for the scaffolding or shape/frame of the Excel rating calculations in terms of rows and columns)

- Rating Tables in Excel Format

- Rating Inputs – The devil is in the details, and a detailed list of desired inputs saves time and removes ambiguity.

- Sample Dec Page

Excel Rater Development Consulting

Joshua Wilson Consulting designs, creates, and maintains Microsoft Excel insurance rating spreadsheets and workbooks (also known as Microsoft Excel automated insurance raters) that transform your underwriting manuals into rating algorithms and precise specifications.

Our automated Excel insurance raters bring you improved analytics and insights by displaying the rating impact of adjusting rates, discounts, surcharges, and fees. Our raters identify each calculation point, and explain every formula in terms that your “non-numbers people” can understand.

No more rating policies by hand, writing out long form interpolations, or guessing which coverages would be most profitable to bundle. Our Excel rater spreadsheets give you quick and easy quoting, ensure consistency, and help you analyze rating scenarios, such as whether to calculate discounts using the multiplicative or additive method.

More than four dozen insurance policies with various companies use our rating algorithms to accurately rate their policies. We’ve created over fifty automated Excel insurance raters resulting in thousands of satisfied insurance customers.

Whether you’re thinking of offering a new plan, operating in a new state, or revising an existing plan; whether you’re offering homeowners insurance, commercial insurance, flood insurance, or medical malpractice insurance; whether you need analysis, need to create precise software specifications, or need to see your underwriting manual draft in action, put our automated Excel insurance rater team to work for your business.